INVEST NOW at https://www.thinkcoin.io/

What is ThinkCoin?

ThinkCoin is the digital trading token that underpins the TradeConnect network. By buying ThinkCoin tokens (TCO) during the Pre-ICO and ICO phase, not only you are getting onboard at revolutionising global trading – you’re doing it at the most favourable price for you.

The TradeConnect Vision

The problem

Global fnancial markets are dominated by banks and other fnancial institutions, some of which lack transparency, have undue influence on global asset prices, and can impose unfair charges. New technology means we can now deliver greater transparency and equality for all market participants. Established fnancial players have failed to take the opportunities in blockchain technology, and still use a centralized order book to control prices and trading.

Other limitations include:

●lack of transparency in price-making and trade execution ●settlement of trades and funds can take days, versus seconds on the blockchain

●lack of flexibility in transferring trades

The solution

We will create a cutting-edge new multi-asset trading network that will disrupt and democratize trading.

We are calling this network TradeConnect.

This network will allow individuals and institutions to trade directly with one another on a balanced playing feld with lower costs for all. Trades will be automatically settled on the blockchain, with recording and execution conducted off-chain to deliver the fastest service possible.

To raise funds to design and develop the network, we are launching an ICO of ThinkCoin, a bespoke new digital token that will underpin trading on the network.

ThinkMarkets: A Decade of Innovation and Growth

The ThinkMarkets group - including TradeInterceptor, ThinkPrime, ThinkAfliates and ThinkInvest has pooled its knowledge and resources to create the TradeConnect project. Together, they combine decades of global experience in fnancial products, excellent customer service and a large pool of tens of thousands of users around the world.

ThinkMarkets: A story of growth

Since its inception the company has grown its global revenues 20% year-on-year with no outside investment. A global fnancial services frm, we are committed to becoming the leading provider of blockchain-based trading solutions and creating the “Think” token economy using TCO.

Trade Interceptor by the numbers

Trade Interceptor is a mobile trading app with almost a decade of history and over 500,000 lifetime registrations. Trade Interceptor will power the user interface for the TradeConnect network.

A breakthrough in fnancial products

The TradeConnect network is poised to bring signifcant and lasting change to the trading of fnancial products by creating the frst true multi-asset blockchain based trading network connecting individuals, prime brokers, corporations and brokers on an even playing feld. We will combine transactions made on and off the blockchain, which will allow us to settle contracts faster than conventional trading and beneft from the trust inherent in distributed ledger technology.

Derivatives

As part of the ThinkMarkets Group, we will start with what we know: derivative contracts in the CFD, Forex (FX), commodities, equities and cryptotrading markets. ThinkMarkets already provides these products to thousands of customers around the world as a regulated broker.

Our knowledge and experience mean we are wellplaced to expand and extend the TradeConnect network, and to ultimately offer trading in other fnancial products to all participants

How derivatives work

At its heart a derivative trade is a contract between one party and another. They agree that one will ‘win’ and one will ‘lose’ in the event that the price of an underlying product either increases or decreases.

The underlying product can range from individual shares, indices, foreign exchange, commodities, metals, and many other fnancial assets. In theory, derivatives can be based on almost anything two parties are willing to agree to base a trade on

The underlying product can range from individual shares, indices, foreign exchange, commodities, metals, and many other fnancial assets. In theory, derivatives can be based on almost anything two parties are willing to agree to base a trade on

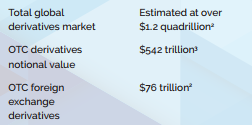

Market Size

The markets that TradeConnect will initially target are signifcant in size. With tens of billions in traded volume a day, there is a signifcant opportunity for an insurgent disruptor.

Current market challenges

Derivative trading markets are mature, but new technology has revealed several areas where the status quo is failing.

a. No peer-to-peer trading

Trading is currently dominated by brokers and counterparties with whom individuals are obliged to open an account to start trading. Individuals cannot easily trade directly with one another, limiting the marketplace. TradeConnect will allow individuals to trade with each other, eliminating the need to use a broker. Trading on the blockchain will transform the way individuals invest their money and trade.

b. Liquidity and Inefcient Pricing

There is a lack of liquidity in markets when they are volatile or if rapidly-developing news move markets fast. Naturally most liquidity providers and exchanges become latent in their prices and suffer from liquidity gaps.

TradeConnect’s trading model is designed to avoid this by creating a unique trade scoring system that facilitate liquidity for users, a scalable connect fee model, a risk based approach to margin lending and a private consortium-based blockchain ledger open to participants in the network for full transparency

TradeConnect’s trading model is designed to avoid this by creating a unique trade scoring system that facilitate liquidity for users, a scalable connect fee model, a risk based approach to margin lending and a private consortium-based blockchain ledger open to participants in the network for full transparency

c. Lack of trust and integrity

Trading with brokers requires clients to trust in their integrity. While many brokers are properly regulated, others may not be. There are also signifcant disparities in rules and regulations between jurisdictions, and potentially signifcant conflicts of interest for the broker to manage.

d. Managing client money

Clients are required to deposit their money with the broker and rely on them to hold it segregated from their own and in trust for the client. Such requirements vary by jurisdiction and many unregulated brokers do not provide adequate protection to their clients. By using the TradeConnect network and with all assets verifed on the blockchain using TCO, participants do not have to worry about settlement of funds and their money being sent to a broker.

e. Ineffcient settlement and payment

Settlement of trades can take time in the current model of investing and trading. There are many cases where fnancial institutions have collapsed when they were not able to settle their funds, and individuals have lost their money. By conducting trades on the blockchain using the TradeConnect network with TCO as a method of settlement, this risk is substantially reduced.

f. Lack of transferability

Trades with a broker may not be transferable. The contract terms are written solely between the client and the broker, limiting the trade’s potential and increasing costs. This makes it harder for traders to transfer positions or trades and reduces flexibility. Our new trading technology will change that by allowing users to trade with other users on the network and transfer their positions at any time.

The TradeConnect network

We intend to develop a multi-asset blockchain-based trading network. To reach the speeds of execution and settlement modern markets expect, the network will combine blockchain-based smart contracts with off-chain transactions.

This solution will beneft from:

●the trust, integrity and visibility of the blockchain ledger

●the ability to hold and settle funds on the blockchain

●the greater speed of using off-chain processing

● A consortium-based private ledger visible to only participants in the network combined with the public blockchain

●the trust, integrity and visibility of the blockchain ledger

●the ability to hold and settle funds on the blockchain

●the greater speed of using off-chain processing

● A consortium-based private ledger visible to only participants in the network combined with the public blockchain

TradeConnect removes reliance on brokers and other intermediaries and enables direct trading between two or more participants. Your money stays in your control, with funds for trades committed to the blockchain pending execution and settlement of the trading contract. Settlement and payment can be nearimmediate, with no delays and no fees for transferring funds.

The TradeConnect Economy

TCO tokens are classifed as utility tokens. Participants in the TradeConnect Network that wish to trade and use all its features will need to hold ThinkCoin tokens. These are the units of trade in our token new economy.

By transferring fat currency or other cryptocurrencies into TCO, traders can trade in the various markets offered on the network. The value of the trade is held securely in an Ethereum smart contract and is settled and released directly back to the participants wallet automatically upon determination of the trade.

By transferring fat currency or other cryptocurrencies into TCO, traders can trade in the various markets offered on the network. The value of the trade is held securely in an Ethereum smart contract and is settled and released directly back to the participants wallet automatically upon determination of the trade.

TradeConnect Token Economy

TradeConnect has a token economy that is marketneutral and, unlike other exchanges and principal market making brokers, is primarily based on transactional volume vs “risk taking”. The structure of the network will allow a diverse token economy based not just on commissions, but a variety of market-neutral models based on the growth in volume versus the market risk in the network .

The primary sources of revenue are the Connect Fees, Margin Lending, auctions of Digital Personas and Token Listings.

TradeConnect in relation to traditional trading

How TradeConnect will work

Transaction speed, liquidity and user base

There are three factors that will determine the success of the TradeConnect network:

• the number of participants in the network,

• the speed at which the transactions are confrmed

• the maintenance of enough liquidity to ensure all transactions are matched and executed instantly.

Trading, participants and therefore liquidity will be incentivised by the Connect Fee.

• the number of participants in the network,

• the speed at which the transactions are confrmed

• the maintenance of enough liquidity to ensure all transactions are matched and executed instantly.

Trading, participants and therefore liquidity will be incentivised by the Connect Fee.

A hybrid approach to the blockchain

The blockchain has certain limitations that could make delivering these guarantors of success difcult. If we assume each trade is offered as a smart contract on the blockchain, a signifcant number of ethereum transactions would be required regardless of whether each trade is then accepted by a counterparty. This approach would cause signifcant delays across the whole ecosystem and cause transaction times to expand signifcantly.

A simple trade would require two ethereum transactions:

● A Market Maker offering their trade

● A Counterparty accepting the offer

● A Counterparty accepting the offer

Off-chain transactions - aggregation and netting

To overcome these challenges, we propose creating and initially storing trading contracts off-chain on the TradeConnect network to settle the majority of the price-making and liquidity-matching transactions near-instantly. Once these transactions are settled offchain, the proft and loss are aggregated as one bulk transaction onto the ethereum blockchain and then netted out.

Post-Trade Ledger Private BlockChain Ledger: A Hybrid Approach to Centralized Trust

As the volume the network grows we anticipate there will be a greater dependency on verifying the actual process of the connect fees, persona auctions, margin lending pools, distribution of the connect fee rebates from the maker/taker pools, and more.

Mid Market Price The Search for the truth

In any fast-moving market such as cryptocurrencies and FX trading, there will be times when market makers will pull their bids and offers based on their perception of risk, volatility, and liquidity

Introducing ThinkCoin

ThinkCoin tokens will power the trading environment as the unit of all trades on the TradeConnect network

Our Initial Coin Offering

During the initial coin offering (ICO), TradeConnect will issue virtual currency tokens called ThinkCoins (TCO).

There are many reasons why we have chosen to carry out an do initial coin offering (ICO). First, an initial coin offering not only allows us to onboard participants from different regions, but also to incentivise them to promote the TradeConnect network via afliate commissions.

There are many reasons why we have chosen to carry out an do initial coin offering (ICO). First, an initial coin offering not only allows us to onboard participants from different regions, but also to incentivise them to promote the TradeConnect network via afliate commissions.

Token Detail

Token Distribution

THE ALLOCATION OF FUNDS

So join now and invest at https://www.thinkcoin.io/

Source- https://www.thinkcoin.io/

MORE INFORMATION :

Website : https://www.thinkcoin.io

Whitepaper : https://docsend.com/view/qgyaq2y

Twitter : https://twitter.com/ThinkCoinToken

Facebook : https://www.facebook.com/ThinkCoinToken/

Telegram Community Group: https://t.me/thinkcointoken

ANN ICO THREAD : https://bitcointalk.org/index.php?topic=3077146.0

Authorized By:

My Bitcointalk account : jagadlangit

My ETH address : 0xA2BFa48A6AfEFaBF498B6541f609E6cef4700D91

No comments:

Post a Comment